Resident views sought ahead of 2023/24 Council Tax budget

Date published: 24th November 2022

This consultation is now closed

North Norfolk District Council is holding a resident consultation for the 2023/24 budget, seeking Council Taxpayers views on whether the authority should increase its proportion of the 2023/24 Council Tax bills and whether it should allocate any proposed increase towards projects and support for the most vulnerable in our communities respond to cost of living pressures.

Each year, the Council sets its’ budget and allocates Council Tax income towards the functions and services it provides to residents in North Norfolk.

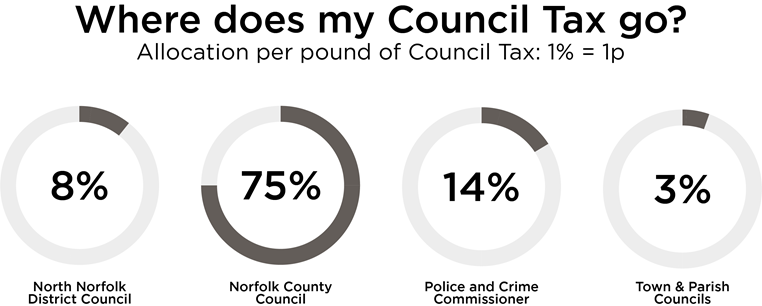

Council Tax collected by the District Council is split between Norfolk County Council, Norfolk Police and Crime Commissioner, North Norfolk District Council, and town/parish Councils. For every £1 of your Council Tax bill, North Norfolk District Council retains just 8p for all the services it provides.

This year, the District Council is asking residents their preference for some of the following options:

- Freezing Council Tax for next year

- Raising Council Tax by £5 (for an average Band D property but by less for the majority of households) for general council expenditure which is experiencing significant inflationary pressures

- Raising Council Tax by £5 per year (for an average Band D property but by less for the majority of households), but ringfencing the additional income to support cost of living measures for vulnerable households.

The survey will run for 3 weeks, ending on 12 December 2022. This consultation is non-binding but will inform the Cabinet on residents’ views when it comes to setting the budget.

These proposed options only reflect the portion of Council Tax income that North Norfolk District Council charges and collects – any changes in your Council Tax bill administered by Norfolk County Council and Norfolk Police and Crime Commissioner will still be reflected in Council Tax bills for 2023/24.

Raising the Council Tax precept by £5 per annum (10p a week for an average Band D property), raises an estimated £210,000 in funding to the District Council, which could be ringfenced to support initiatives such as foodbanks, food hubs and warm hubs.

Another option is to freeze Council Tax for the year. This would see a reduction of income of approximately £210,000 to NNDC – representing a significant real terms cut as inflationary pressures on existing contracts and services including the Council’s outsourced waste and recycling and leisure contracts are significant. Any freeze of the District Council’s element of the Council Tax bill is therefore likely to involve difficult decisions about potential service reductions.

The £5 per year figure is based on a Band D property and will be scaled between bands.

|

Number of properties by band for 2022/2023 |

||||||||

|

A |

B |

C |

D |

E |

F |

G |

H |

|

|

11917 |

14488 |

11749 |

9080 |

5028 |

2393 |

1070 |

82 |

|

Based on 55,807 properties on the Valuations List, should Council Tax be raised by the £5 per year/10p per week increase for a Band D property, nearly 85% percent of properties would see an increase in their District Council element of the Council Tax bill, of less than 10p per week.

|

Council Tax Band Increases at a £5 increase for Band D Property |

||||||||

|

Band |

A |

B |

C |

D |

E |

F |

G |

H |

|

Current Figure |

105.78 |

123.41 |

141.04 |

158.67 |

193.93 |

229.19 |

264.45 |

317.34 |

|

Per Year (£) |

3.3 |

3.85 |

4.4 |

4.95 |

6.05 |

7.15 |

8.25 |

9.9 |

|

Per Week (£) |

0.06 |

0.07 |

0.08 |

0.1 |

0.12 |

0.14 |

0.16 |

0.19 |

|

New Figure |

109.08 |

127.26 |

145.44 |

163.62 |

199.98 |

236.34 |

272.7 |

327.24 |

NNDC has one of the lowest Council Tax precepts for all district councils. Of 188 District Councils in England, over 80 per cent have a higher Council Tax precept than North Norfolk.

View a full list of current NNDC Council tax rates and bands.

The Council froze Council Tax in the 2021/22 financial year recognising the uncertainties many local people faced through being on furlough as a result of the COVID-19 pandemic. As such, Council Tax has not kept pace with inflation over the past few years, and with increasing costs the impact of delivering public services is increasingly challenging and could potentially lead to some of the Councils’ discretionary services needing to be reduced or removed.

Who does my Council Tax go to?

Council Tax in North Norfolk is divided between Norfolk County Council (NCC), North Norfolk District Council (NNDC), the Norfolk Police and Crime Commissioner (NPCC) and Town & Parish Councils.

The below graphic shows the distribution of Council Tax between the authorities – 8p per £1 of Council Tax is retained by North Norfolk District Council.

In the coming budget year, Norfolk County Council and Norfolk Police and Crime Commission Council Tax precepts are anticipated to rise, raising the total Council Tax bill.

Compared to many local authorities, NNDC is in a healthy financial position but rising costs and inflation will put strain on this position moving forward over the next twelve months.

View a costed breakdown of how tax income is dispersed: Home | Council Tax: How is it spent (north-norfolk.gov.uk)

What services does my Council Tax pay for?

Norfolk County Council’s 2022/23 budget is £1.6 billion and covers services such as children’s services (including schools), adult social services, community and environment services and general finance (inc. money set aside for capital projects)

At District Level, expenditure is split into capital and revenue – capital spending is one-off projects such as The Reef, major improvement works (such as Cromer Pier works and the North Walsham HAZ programme), initiatives (such as new affordable housing and purchase of temporary accommodation) or infrastructure procurement (such as development of Changing Places and improved public toilets in recent months).

Revenue spending covers the Council’s wider service provisions, such as coastal management, environmental services and culture and recreation (including leisure centres and public parks) to name a few.

The Council Tax precept for the Police and Crime Commissioner sets the budget for policing in the county – see the full breakdown from Norfolk Police

Last updated: 21st December 2023